#Fintechgration Is Coming

The Capital Markets are constantly evolving. Especially, disruptive technologies are pushing boundaries within the FinTech space of Capital Markets. Being part of this journey, is one of the main reasons for why I joined Capital Market Partners(CMP). At CMP, I have the opportunity to develop my passion for FinTech and have focus on future trends and technologies from a business perspective. For this reason, my colleague Sebastian Olguin Sørensen and I would like to give our view on FinTech in the Capital Markets, how it will evolve in the coming years, and what to prepare for. We will launch our FinTech initiative, Fintechgration 7×7 Pitch Event on June 21st — The event is open for everyone, but offers limited seating, so join now!

By Varan Pathmanathan, Sales and Business Development & Sebastian Olguin Sørensen Finance I 25 April 2018

In this blog post, we will first introduce you to the technological trends that support innovation in Capital Markets, and after, we take a look at the domains of Capital Markets and map these with technological opportunities. Finally, we will introduce you to the global Capital Markets FinTech landscape and highlight some of the interesting startups to keep an eye on.

Introducing FinTech to the Capital Market

The focus, in the FinTech sphere, has mainly been on payments, P2P lending and equity crowd funding sectors. However, over the past two years, we have seen a large increase in the activity of Capital Markets FinTech — especially from a global perspective.

Several FinTech startups have ascended around the globe, giving life to new solutions in Front, Middle and Back Office of Capital Markets. These FinTechs have engaged in creating solutions to challenges, which have not yet been solved by the legacy trading platform systems.

New FinTechs are applying new technologies, such as Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), Distributed Ledgers through Blockchain and of course various cloud technologies. These solutions assist in the development of delivering stellar solutions, that previously were hard to achieve in the legacy systems, because of less computing power, spaghetti code written in the 90s, and so on.

Opportunities in Capital Markets are massive

Whether you see FinTech solutions as a tool for sales people or traders to make better decisions by using advanced technologies, such as AI and Machine Learning, or you see it as a cost-effective tool to help reduce costs through post-trade processing solutions, one thing is for sure; the opportunities within this space are massive! But before looking into the opportunities in this space, let’s have a look at the technological areas, where we believe FinTechs can improve the workflow in the Capital Market.

The Technological Landscape

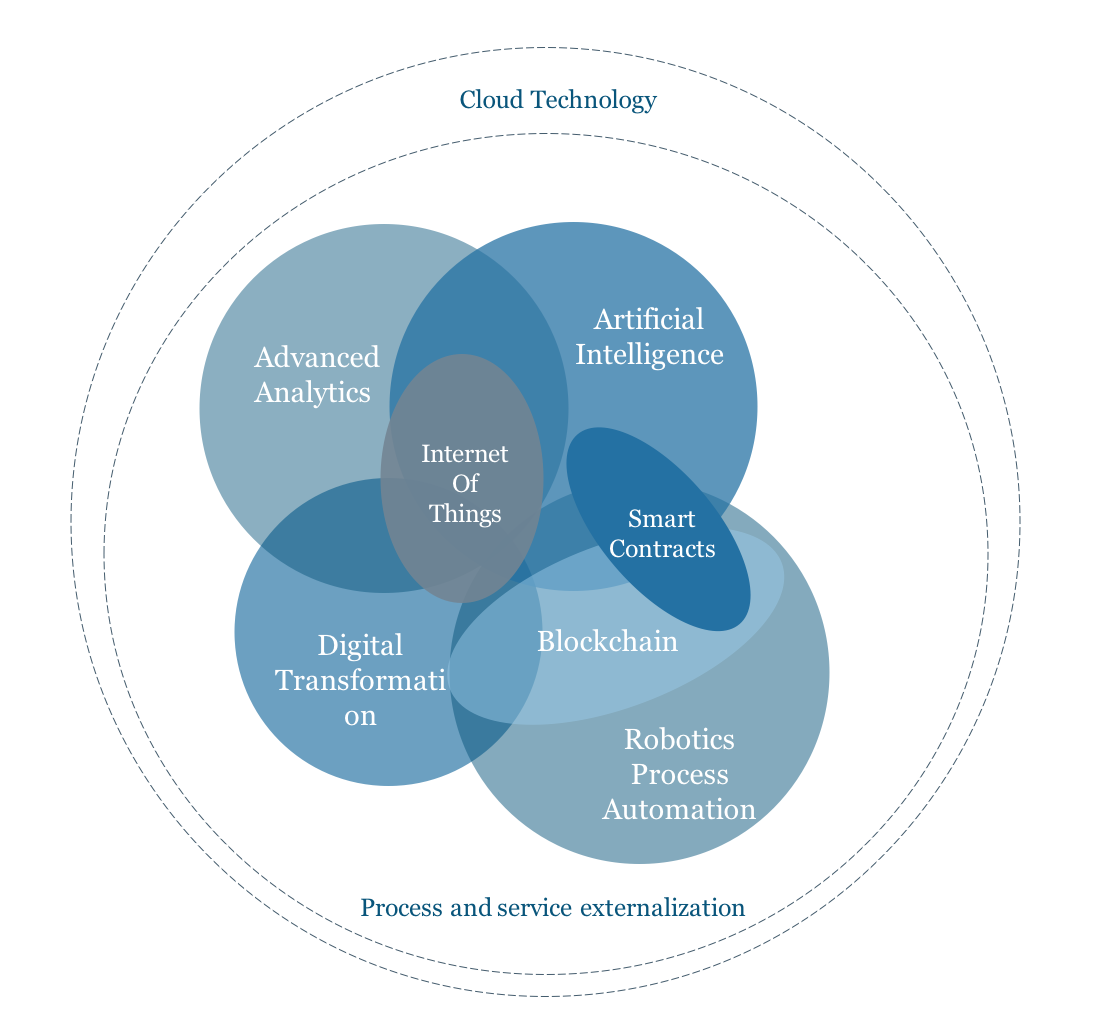

Technology-Enabled Trends to Support Innovation in Capital Markets | Source: EY

The illustration above highlights seven technology-trends, that are making innovation possible — either on their own or combined: Advanced Analytics, Internet of Things (IoT), Artificial Intelligence (AI), Smart Contracts, Blockchain, Digital Transformation & Robotic Process Automation.

“Cloud Technology” and “Process and Service Externalization” (outsourced solutions, APIs etc.) are surrounding the seven technology-trends and are key areas in the listed seven.

Trending Technologies on a Short and Long-Term Perspective

We believe that the biggest benefits in the short-term, will arise from innovation based on Advanced Analytics, RPA and Digital transformation.

However, we see that Blockchain and AI could present game-changing opportunities in the longer term in the Capital Markets sector. But, it is too early to define and set a direction right now.

Cloud technologies are already here today, but for the established financial institutions, there is still a way to go before everything is up in the cloud. At the same time, we are witnessing new banks (digital banks) that challenge the setup and work entirely in the cloud. Our belief is, that the quickest way to get established financial institutions onboard, on the various cloud solutions, is by partnering up and work in collaboration with the FinTechs, which are born in the cloud.

Capital Markets Domains from Front to Back

If we should define areas of Capital Markets in Front, Middle & Back Office, it could look like the domains illustrated below (including HR, Legal & Compliance). All the domains have a variety of processes and functions within Capital Markets, where there are many opportunities to use technology to enhance and optimize the experience.

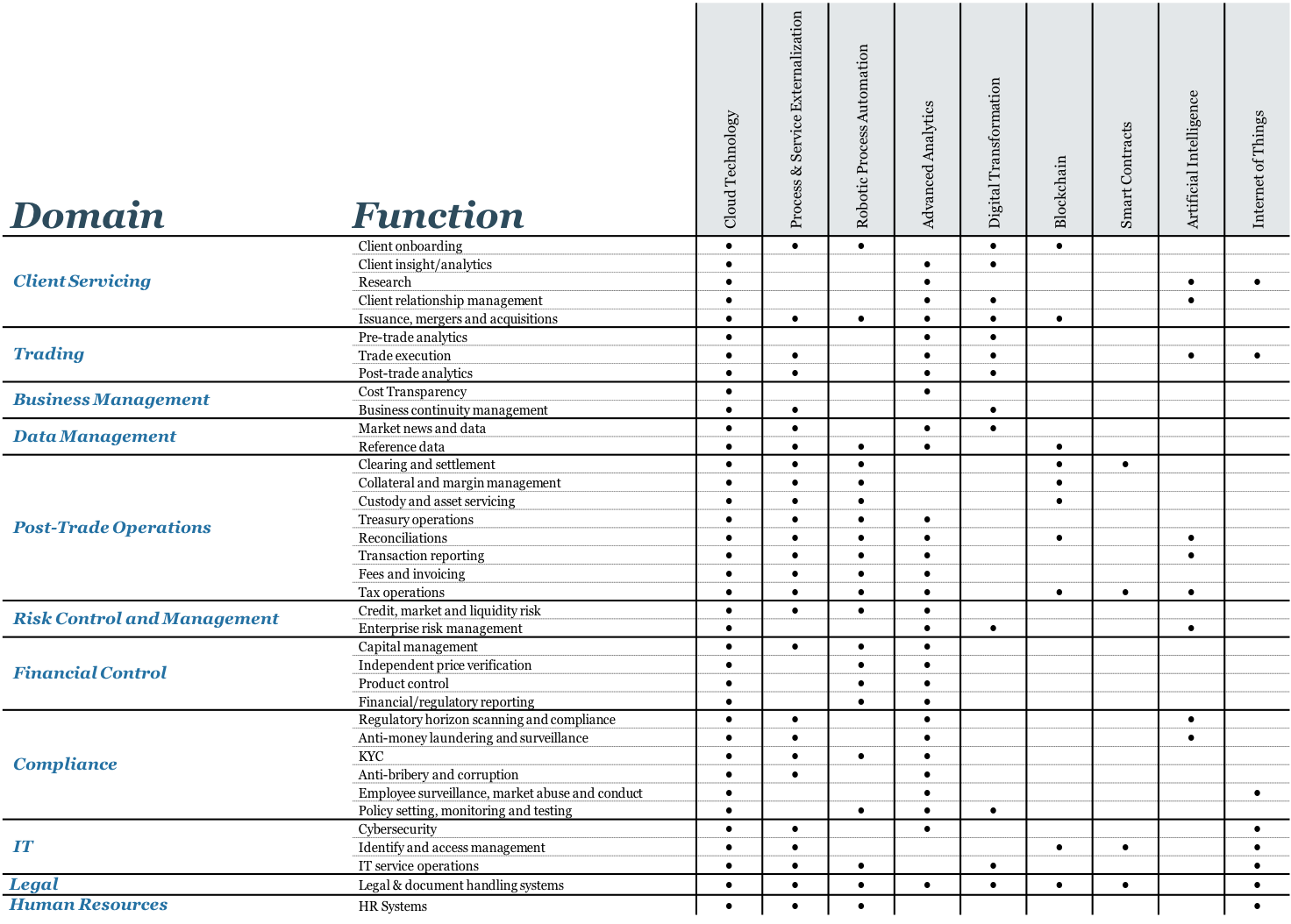

Capital Markets domains/areas from Front to Back Office perspective | Source: Capital Market Partners

Capital Markets Domains and Mapping in Technological Trends

A great way to understand the opportunities with and in FinTech is by mapping the various domains and their processes/functions within Capital Markets to the technological trends.

Below you will find a table, where the domains and their processes/functions are mapped to the technological trends, where we see most opportunity to make use of. This means, that if you are a decision maker in one of the mentioned domains/areas and would like to make use of the new trending technology, it is interesting to look into the specifically mapped technology for the specific domain/area.

Capital Markets domains/areas from Front to Back Office perspective | Source: Capital Market Partners

FinTech Landscape in Front- Middle & Back Office

From a global perspective, the number of FinTechs within the Capital Markets area is increasing. The following figure is mapping the current (non-exhaustive) landscape within Capital Markets FinTechs.

The map illustrates the various startups that pose great opportunities for established financial institutions to collaborate and create partnership with | Source: CB Insights

Automization of Back Office by ML & AI

If we take a look into Back Office processes, several FinTechs have already made their entry and started collaborating with established global financial institutions.

The following selected FinTechs represent a selection of the companies, that we believe will be interesting to follow in the near future. From Risk Identification, Compliance Intelligence, behavioral analytics to background screening and KYC.

Selected Back Office FinTechs using AI & ML technologies | Source: CB Insights

#Fintechgration — Enabling Collaboration

Source: Capital Market Partners

At CMP, we believe FinTech is a big part of the future in Capital Markets. The established financial institutions are looking into a future, where collaboration and partnership are key drivers for success and staying ahead of the curve. Collaboration and enabling partnerships, or as we call it — Fintechgration— is therefore key, but getting there requires the right mindset from both parties.

The established financial institutions have legacy systems, strong governance and history in contrast to the FinTech startups that have none of those. These different “worlds” and mindsets can make the process of Fintechgration slow and inefficient, especially from a time-to-market perspective.

It is essential to set the right Fintechgration strategy on how the established financial institution can and would like to collaborate/partner up with FinTechs. Equally important is the task of setting the right team in terms of project management, implementation/development, to enable and ensure a successful Fintechgration.

CMP Fintechgration — Launch June 21st 2018

Establishing the right Fintechgration strategy is important, which is why CMP is looking into new opportunities in the area of Capital Markets FinTech, and will be launching the FinTech initiative “Fintechgration”:

As a niche consultancy company in the Capital Markets area, we commit to help established financial institutions with a successful Fintechgration.

Therefore, we would like to invite all Capital Markets enthusiasts to our launch — Thursday June 21st, 2018. Here, we have invited established institutions to pitch their use of technological trends together with FinTechs, who operate in the periphery of Capital Markets.

Read more about the event, register your attendance and invite friends and colleagues here.

Register your attendance here (limited seats available)

Stay Tuned, Stay Inspired

Varan Pathmanathan, Sales & Business Development

Varan Pathmanathan has extensive experience within the financial sector. Where he, among other things, has been involved in business development, IT and sales. Through his capital market experience, Varan will establish FinTech as an integrated part of CMP’s services, as well as consulting on Capital Markets FinTech – Fintechgration

Sebastian Olguin Sørensen, Finance & FinTech enthusiast

Sebastian Olguin Sørensen, Finance & FinTech enthusiast

Sebastian Sørensen is responsible for budget, financial statuses, forecast, liquidity and other economic analysis. He assists our managers and senior consultants, and takes part in developing FinTech as a part of CMP. Sebastian is currently studying a Double Degree in MSc International Business and Politics and CEMS Master in International Management, at Copenhagen Business School.