By Søren Rahbek, Diretor I February 5th, 2023

Summary

The ongoing implementation of EU’s Corporate Sustainability Reporting Directive (CSRD) with its supporting reporting standards (ESRS) will significantly increase the availability of the data investors need to make informed decisions about sustainable investments. This will most likely reduce the demand for ‘ESG Ratings’, where the methodology tends to be rather opaque.

On the other hand, the need to collect, structure and distribute raw data from companies will strengthen the market for other business models.

Background

In a world with limited supply of ESG data, ESG rating providers have been able to build solid business based on their ability to find, extract, and combine data, partly from companies/issuers they have agreements with and partly from broader market analysis. Companies, which are paying for an ESG rating, have an incentive to share all information that can have a positive impact on the rating with the agency. This can be done in confidentiality and some data thus becomes private to the rating provider.

Many ESG raters had a starting point from credit analysis and are used to collecting information on a broad range of companies and markets. The same approach for ESG data obviously also generates solid insights. Rating agencies also have the ability to send out questionnaires and process the results as background.

ESG raters have thus had a unique ability to fill in the gaps between the limited ESG data points reported.

Combined with an often opaque methodology, this effectively creates a black box, which of course can be very valuable.

An important consequence of the credit rating background is that focus of the raters tend to be on the risk and opportunities posed to the company by outside factors and less on the impact the company has on the environment.

What is Happening?

Now this cozy world of charging companies for taking their data and converting it into a scorecard, (and by the way, also selling the scorecards to investors,) is coming under pressure, as the EU is implementing requirements for companies to create sustainability reporting, very alike to the financial reporting.

The Corporate Sustainability Reporting Directive kicked in from the 1st of January 2024 for the largest companies and is supported by a detailed set of reporting requirements under the European Sustainability Reporting Standards.

What is ESRS Data (How Much is Required)

Initially, the sheer volume of data is overwhelming. However, given that the CSRD is a fundamentally new approach to reporting, it might not be that bad. After all, financial reports also contain quite a few datapoints. CSRD serves (at least) two purposes under the headlines of double materiality. One focus of the reporting is the ‘outside in’ perspective of reporting, the impact that environmental and other factors have on the company – both in terms of risks and opportunities. Companies may have operations is areas that are increasingly subject to flooding – a clear risk. Other may have technology that will be needed to mitigate environmental impacts that represents new opportunities.

The other focus of the reporting is the ‘inside out’ perspective of reporting, the impact the company has on the environment and on the society, it interacts with. One important example is the amount of CO2 emitted by the company, either directly from operations or indirectly from purchase of energy – or through the value chain.

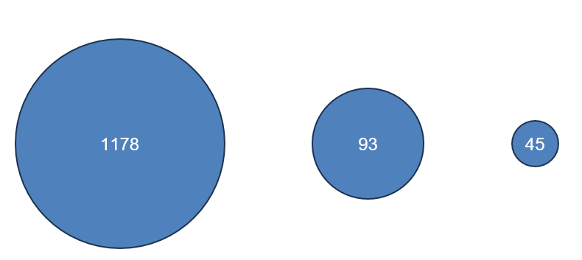

The EU has provided a list of data points – there are 1,178! However, obviously, not all are relevant for all purposes.

The effect of CSRD will be to make the raw (true) ESG data available on companies for investors, thereby increasing investors’ ability to get insights into both ESG risks and opportunities – and the important impact of the investee companies’ impact on ESG factors.

Link to Investor Reporting

As Financial Market Participants are already under an obligation to report on the impact of their investments, it is comforting to realize that there is a strong link between the regulations. The data points required under SFDR are all part of the ESRS. However, it is only a limited number of data points that are required to fulfill the SFDR requirements.

It is also very important for investors’ access to data, that data must be provided in a format that is readable for both humans and machines.

ESRS Data Points ESRS Data points, SFDR PAIs for

required for SFDR Corporates

Source: European Sustainability Reporting Standards and CMP analysis

However, while trustworthy information to investors is critical to ensure funding for the transition to a sustainable economy, it is not the only use of the information. The requirement to report in a structured way on material impacts will create a transparency which will allow all users of data better insights into the ESG impact of a given company and create stronger awareness of the risks that climate change poses to many companies.

In fairness, ESG rating providers are increasingly providing insight into their methodology. This partly reflects pressure from regulators (latest example is MAS in Singapore) under a call for action from IOSCO (International Organization of Securities Commissions). However, as the ability to combine is the value-adding ‘secret sauce’, transparency of ratings will not likely ever be complete.

Direct Availability of Data

As investors’ need will develop over time and at the same time expand beyond the regulatory requirements, there will be a need for comprehensive databases. EU also has a reply to this, as all data needs to be reported to ESAP – European Single Access Point. While there will (eventually) be a single source, we at Capital Market Partners believe that there will be a solid demand for data, made available in a structured fashion, which is easy to integrate with other securities data for investment decision or regulatory reporting.

Our sister company, REGTECH DATAHUB, which already provides banks and asset managers with the regulatory data they need for transaction reporting is expanding into ESG data. REGTECH DATAHUB already provides niche ESG solutions, and is rapidly expanding its ability to source, integrate and distribute raw ESG data. Please reach out to us for further information.

About CMP

Our name, Capital Market Partners, reflects what we define as our core service: Business understanding based on extensive experience in applying technology in the capital market area.

As a business partner, we offer consulting services based on our combination of business understanding and IT know-how. Our work analyzes, implementation of IT systems and other projects supports strategic decisions at different levels in complex business contexts.

For further information – Please contact:

Lars Christiansen

Managing Partner

Tel: +45 2993 4678